Bybit vs Apex Omni (formerly Apex Pro)

When it comes to cryptocurrency trading, centralized and decentralized exchanges offer different functionalities, though they serve the same purpose. As a trader, choosing between these two options is more than just selecting the most popular one; you also have to consider factors such as trading execution tools, trading fees, and exchange usability.

In this guide, we compare Bybit trading features and functionalities to those of Apex Omni, sharing notable features like trading mechanisms, trading fees, and execution methods to determine which exchange is more suitable for new and experienced traders.

Quick Note: With over 300 trading pairs, Bybit remains the best option for beginners, particularly if you live in a country where Bybit is supported and don't know a lot about security risks in the crypto space. Apex Omni is suitable for experienced traders who want control of their assets or live in countries where Bybit does not operate.

| Situation | Best Option |

| Residing in a Regulated Country (KYC possible) | Bybit |

| No-KYC option, Best For Restricted Countries |

Update: Apex Pro has been rebranded and upgraded to Apex Omni. Apex Omni is the successor to Apex Pro, offering a similar decentralized trading experience with additional features and broader ecosystem support.

Want to start trading on Bybit? See our guide on how to earn welcome and deposit crypto bonuses on Bybit.

What is Bybit?

Established in 2018, Bybit is a leading centralized exchange trusted by many users for its security and battle-tested features. Since its introduction, the exchange has stood out not just for its deep liquidity and easy-to-use interface but because Bybit has survived years without regulatory challenge, repeated hacks, system congestion, or hiked fees. So, for traders who are more interested in a bit of stability and enhanced security, Bybit is usually the go-to option.

However, due to regulations in countries like the United States, Canada, Singapore, and North Korea, Bybit is not available for use. Therefore, traders could consider the closest alternatives, such as Apex Omni, which is accessible from those restricted countries.

What is Apex Omni?

In 2024, Apex Pro transitioned into Apex Omni, a multi-chain decentralized crypto exchange developed by Apex Protocol and invested in by Bybit for perpetual trading. Apex Omni is more like an upgraded version of both Bybit and Apex Pro, as it addresses the regulatory barriers users experience on Bybit and eliminates the bridging risks that were initially part of Apex Pro.

Users experience CEX-like trading on Apex Omni because of its high speed, up to 100x leverage, and low slippage. This makes Apex Omni one of the best DEXes for users in restricted countries who are done with repeated smart contract exploits or fragmented liquidity that comes with bridging assets within protocols.

Is Bybit Better Than Apex Omni? Comparing Trading Speed, Volume, Fee, and Performance

Now, let's compare how trades are executed on Bybit and Apex Omni, including liquidity, leverage, supported markets, and available trading models.

Orderbook and Trade Execution

Bybit operates a centralized orderbook that follows a price-and-time priority system. Orders offering the best price are matched first, and when multiple traders submit orders at the same level, the earliest order receives execution priority.

Because of this model, Bybit can process large trading volumes within seconds, even during periods of extreme market volatility. This is one of the reasons many professional futures traders prefer centralized exchanges.

Apex Omni uses a different structure. It combines off-chain order matching with on-chain settlement. Orders are matched instantly outside the blockchain for speed, then finalized on-chain for transparency. The result is fast execution while keeping user custody.

Available Trading Pairs and Markets

Bybit supports 300+ trading pairs, giving traders access to major cryptocurrencies, trending altcoins, and newly listed tokens. Before assets become available, they go through an internal review process designed to reduce risks like low liquidity or potential scams.

On Apex Omni, there are 130 trading pairs. There is also a spot market, but the trading pairs are mostly for derivatives trading as the spot market is pretty limited compared to Bybit, as it functions more as an exchange interface connected to token swaps. The benefit here is that you are able to set limit orders, which on normal swap websites is not possible.

Order Types and Leverage

Both platforms support essential tools needed by serious traders. On Bybit and Apex Omni, users can place:

-

Market orders

-

Limit orders

-

Conditional orders

-

Stop-loss and take-profit setups

Where the difference becomes clear is in leverage. Apex Omni offers up to 100x leverage across most markets, while Bybit typically limits altcoins to lower maximum leverage, reserving 100x mainly for BTC and ETH pairs.

Trading Products and Extra Features

Bybit positions itself as a full trading ecosystem, and sometimes even like a bank. In addition to perpetual futures, traders can access:

-

spot trading

-

futures contracts

-

grid bots

-

copy trading

-

AI analytics

-

tokenized real-world assets and stocks

-

Bybit Card (Day-to-day payments with crypto)

For passive users, Bybit also includes staking products and launchpool events, allowing traders to earn yield or token rewards on idle balances.

Apex Omni focuses more on non-custodial derivatives trading, but it has expanded rapidly. Traders can use grid strategies, trade tokenized assets, and perform spot swaps across multiple chains while maintaining wallet control.

Speed and Gas Costs

Apex Omni is built for performance and can process thousands of transactions per second. Because trades are matched off-chain, users avoid gas fees for normal trading activity. Fees usually apply only when depositing or withdrawing.

Bybit, as a centralized exchange, does not require blockchain interaction for trades, which also allows for near-instant execution without network costs.

Summary: Bybit is built for all-round users. Besides trading, it offers everyday financial tools such as earning products, launch events, and even a crypto card, making it feel similar to a digital bank. Apex Omni, on the other hand, focuses mainly on derivatives trading and self-custody, giving experienced users more control over their funds and on-chain activity.

Is Apex Omni Cheaper Than Bybit? Comparing Trading Fees

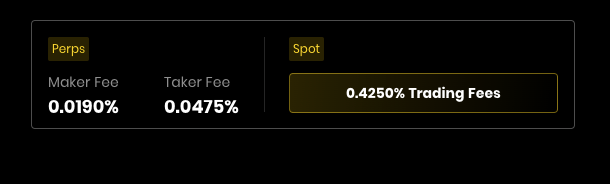

For lower trading fees, Apex Omni is the best option. Bybit charges a standard 0.02% maker fee on all limit orders (limit order is filled at the predicted price and adds liquidity to the order) and a 0.055% taker fee on all market orders (market order is filled immediately at the current market price and takes liquidity from the exchange's order book). Apex Omni charges a 0.0190% maker fee and a 0.0475% taker fee for perpetual trading, and a 0.0425% trading fee on all spot trading. This makes Apex Omni a good choice, particularly for high-volume traders and grid traders.

However, if you prefer Bybit, you can reduce your trading fees by applying the MNT discount or the Bybit VIP benefit. You can get a 20% fee discount when you pay trading fees in MNT, or get up to 50% off fees with Bybit VIP benefits.

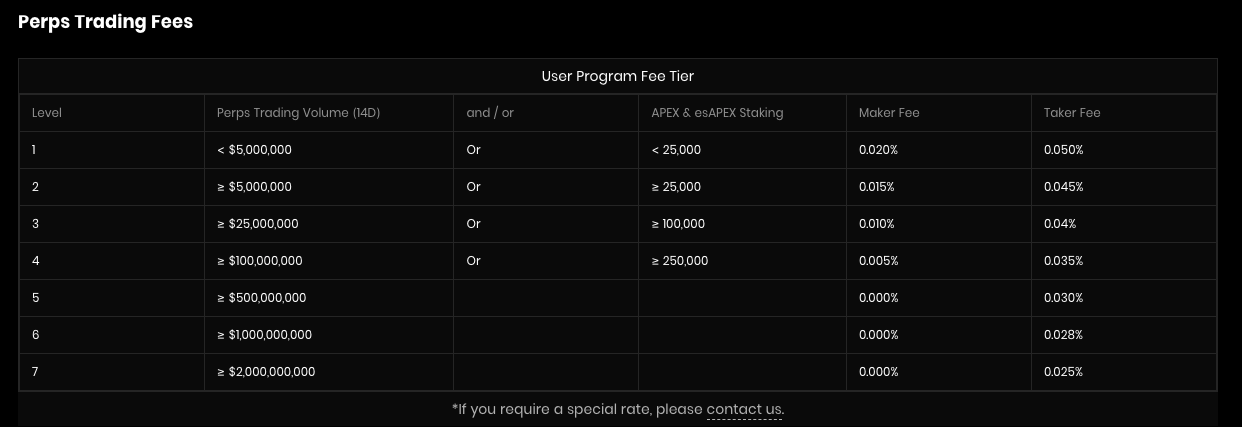

Note that Apex Omni also offers fee discounts as part of its VIP benefits, allowing high-frequency traders to reduce trading fees by up to 50% depending on their VIP tier. This makes Apex Omni a cheaper option.

Apex Omni Trading Fees and VIP Tiers

Key points

- Bybit and Apex Omni are both suitable for future trading; however, Bybit offers additional trading models like copy trading, AI trading, and Tradfi.

- Apex Omni replaces copy trading and passive income with the Apex Omni Vaults.

- Compared to Bybit, Apex Omni has lower trading fees, and you can further reduce them with Bybit or Apex Omni VIP tiers.

- Bybit vet tokens before they are listed on the exchange, Apex Omni does not vet tokens, leaving users to DYOR before trading an asset.

Want To Start Your Journey On Apex Omni? Sign Up Using Our Affiliate Link And Receive 5% Discount On Your Fees

Bybit Copy Trading vs Apex Omni Vaults

The Bybit copy trading and Apex Omni Vaults serve the same purpose. First, using any of them means you do not need to trade actively; instead, you follow a lead trader's trading strategy. Also, you can close a copy trade manually before the lead trader. Similarly, you can withdraw your funds from the trading pool anytime under the Apex Omni Vault.

However, there is a significant difference here: with copy trading, you are simply replicating the lead trader's strategy in your own account. However, Apex Omni Vault allows investors to add funds to a decentralized copy-trading vault based on the main trader’s strategies. Rewards and losses are shared among everyone based on how much they contributed to the pool.

To learn about the risks and benefits of joining a vault, see our past article on how to use the Apex Omni vault.

Tip: When using copy trading on Bybit or adding your funds to the Apex Omni trading vault, carefully review the lead trader's portfolio and past trades. It is also recommended that you learn about crypto trading on your own to determine whether a trade will result in a profit or a loss. Never put all your capital in one strategy; it is better to diversify the capital over multiple strategies to reduce the risk.

How To Start Trading on Bybit vs Apex Omni

Getting started on Bybit and Apex Omni is straightforward, but the onboarding requirements are very different.

Creating a Bybit Account

To open a Bybit account, users register with an email address or phone number and then complete identity verification.

KYC matters because it is mandatory. Without verification, you will not be able to use the platform.

After registering, users may become eligible for promotional rewards and deposit bonuses, which can significantly increase starting capital.

Sign up to Bybit through our link and unlock available deposit bonuses.

Creating an Apex Omni Account

Apex Omni follows a non-custodial model and does not require mandatory identity verification.

Instead of creating a traditional exchange account, users connect a decentralized wallet and can begin trading within minutes.

Because there is typically no formal KYC step, Apex Omni is often considered by traders who cannot access certain centralized exchanges.

Once connected, users usually fund their trading account with USDT or USDC on supported networks such as Ethereum, Arbitrum, Base, BNB Chain, or Mantle.

Connect to Apex Omni using our link and receive a 5% discount on trading fees.

Availability by Country

Bybit restricts services in several jurisdictions due to regulatory requirements. Traders should always check whether their region is supported before registering.

Apex Omni, as a decentralized platform, is generally accessible globally, though availability can still depend on wallet providers or front-end policies.

You can review the latest restricted locations in the Bybit restricted country list.

Summary: Bybit focuses on verified accounts and a full-service trading environment, while Apex Omni emphasizes fast access through wallet connection and non-custodial control.

Security on Bybit vs Apex Omni: Which One Is Safer?

“Not your keys, not your crypto” is a well-known phrase in digital asset markets. It highlights the difference between trusting an exchange to safeguard funds and holding assets in a personal wallet.

Bybit operates as a custodial platform, meaning user balances are held within exchange-managed wallets. To reduce risks, Bybit applies multiple layers of protection, including cold storage systems, multi-signature authorization, two-factor authentication, and anti-phishing safeguards.

Even with strong infrastructure, centralized platforms can remain attractive targets for attackers. Past security incidents across the industry demonstrate why some traders prefer to limit how long funds stay on an exchange.

Practical tip: many users trade on Bybit but move long-term holdings to private or cold wallets when they are not actively trading.

Apex Omni follows a non-custodial model. Instead of holding customer funds, the platform connects to assets that remain on the blockchain in the trader’s own wallet.

This structure removes exchange custody risk but shifts responsibility to the user. Access depends entirely on protecting private keys and seed phrases. If those are lost or exposed, transactions generally cannot be reversed.

Practical tip: experienced traders often separate wallets — one for interacting with trading platforms and another for long-term storage.

So which is safer?

There is no universal winner.

-

Traders who value convenience, account recovery options, and managed security systems may feel more comfortable with Bybit.

-

Traders who prioritize independence and direct control over assets often prefer non-custodial environments like Apex Omni.

The better choice depends on experience level, capital size, and personal risk tolerance.

Overview: Bybit vs Apex Omni

|

Features |

Bybit |

Apex Omni |

|

Exchange type |

Centralized exchange (CEX) |

Decentralized exchange (DEX) |

|

Custody model |

Custodial - Bybit holds and controls users' assets |

Non-custodial - Users retain control over assets on Apex Omni |

|

KYC Requirement |

Yes |

No |

|

Order Matching and Settlement |

Orders are matched using the centralized order book and settled using the Bybit internal ledger. |

Apex Omni uses an off-chain order-matching system and on-chain settlement via smart contracts. |

|

Supported asset |

Over 300 trading pairs |

Over 100 trading pairs |

|

Trading fees |

Maker fee: 0.02% Taker fee: 0.055% |

Maker: 0.00% – 0.019% Taker: 0.025% – 0.0475% |

|

Gas fees |

Not applicable because there are no on-chain activities. |

No gas fees on trading actions within the exchange. Only applies to deposits/withdrawals. |

|

Fee discounts |

Over 20% discount when you use MNT for the trading fee for non-VIP users. Offers up to 50% discount for VIPs |

Offers only up to 50% discount for VIPs |

|

Multi-chain activities |

Convert and move assets across chains without bridging |

Relatively interoperable with 5 chains |

|

Asset security |

Bybit has the duty to keep the asset secured |

Users have the duty to keep their wallets safe |

|

Risks |

System breach, erroneous transfer, or mismanagement. |

Wallet breach and erroneous transfer. |

|

Best suited for: |

Beginners or experienced traders, passive income and airdrop farmers. |

Experienced or high-frequency traders and grid traders. |

Conclusion

Bybit and Apex Omni deliver a surprisingly similar trading experience in terms of speed, interface, and available order types. For many traders, moving between them feels natural.

The difference lies more in structure and philosophy.

Bybit is the more established platform with deeper spot markets, broader product offerings, and extras like earning features and the Bybit card. Traders who can access Bybit in their country often choose it for the liquidity and the comfort of a mature ecosystem.

Apex Omni, meanwhile, focuses strongly on derivatives and self-custody. It is especially attractive for traders who cannot complete KYC or who prefer to keep direct control over their assets while still enjoying CEX-like execution.

| Situation | A platform that usually fits better |

|---|---|

| You live in a restricted country or cannot pass KYC | Apex Omni |

| Bybit is supported where you live | Bybit |

Tip: You don’t necessarily have to choose only one. Many traders use Bybit for its wide ecosystem and liquidity, while also exploring Apex Omni to diversify counterparty risk or to gain experience with decentralized platforms that are growing quickly in popularity.

Frequently Asked Questions

-

Can I use Bybit in the US and Canada?

No, you cannot. Due to regulatory restrictions, Bybit is not available in the United States. However, you can learn how to use Bybit in the US despite the regulatory barrier.

-

Can I use Apex Omni in the US and Canada?

Yes, as a decentralized exchange, you can use Apex Omni anywhere in the world. It is one of the alternatives to the location barrier that comes with Bybit. For more alternatives to Bybit in the US and Canada, see our article here.

-

If Bybit and Apex Omni do not charge gas fees, why do I still pay trading fees?

On Bybit and Apex Omni, users do not pay gas fees; they pay trading fees instead. While the gas fee covers blockchain-related activities and is therefore paid to the blockchain validators or miners, the trading fee is paid to maintain the market. Hence, you do not pay a gas fee when you adjust order details or swap within the exchange, but you pay trading fees when you add or remove liquidity from the market.

-

Can I earn passive income on Apex Omni?

While Apex Omni does not offer features like crypto staking or launchpools, it does offer an Apex Omni vaults where crypto investors can contribute their funds for a crypto trader to use for future trading. Investors earn 90% of the reward without actively trading and also share in the loss.